Below is an example of how our weekly updated forecast can look like. The content, graphs used etc may differ each week, and should provide a good indication on what to expect.

Note: We forecast and don’t predict nor provide trading advice. Remember, the market is always right. Real benefit will be achieved when followed over prolonged time.

27 Jan 2023

Highlights:

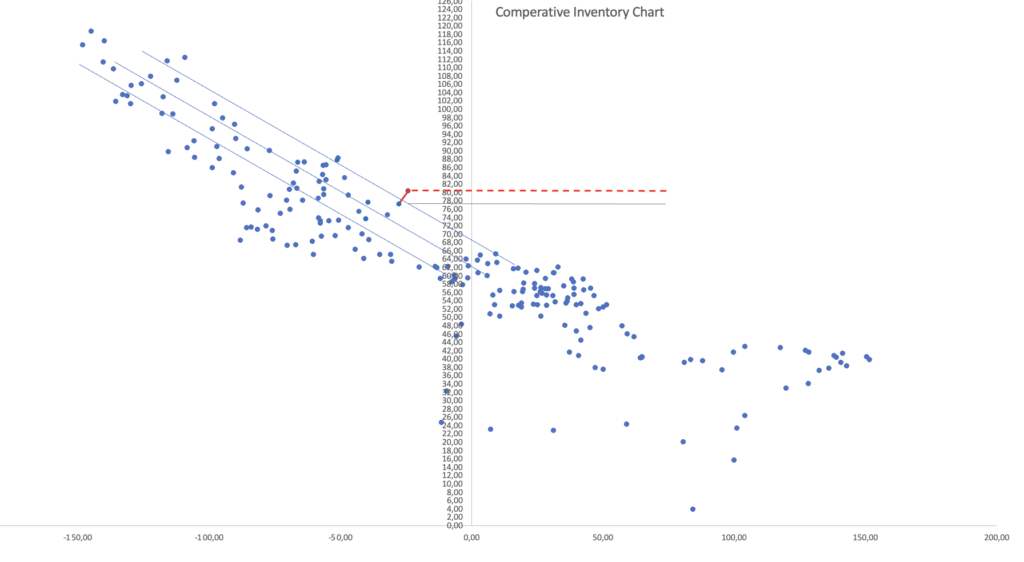

1. This weeks Comperative Inventory increased by 0,3%, which is in line with current trend.

2. The comparative Inventory graph shows price closed above its trend line. Given the C.I. increase this means oil price is on a discovery excursion.

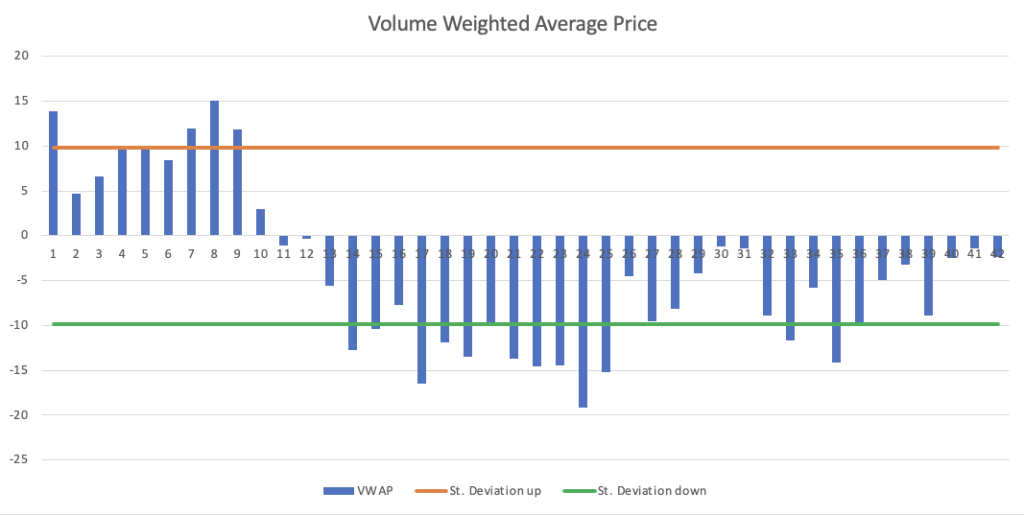

3. The Volume Weighted Average Price closed close to neutral, meaning recent past price increase run out of steam.

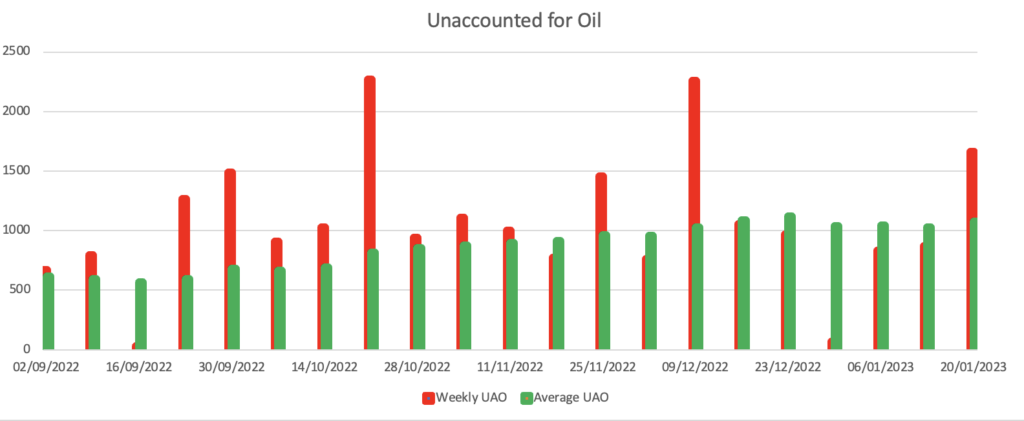

4. The Unaccounted for Oil is substantially above the average. This large withdrawal suggests an expectation that prices may move lower in the future, as oil owners want to maximize profits.

Forecast:

Price excursions may last for weeks and tend to keep prices inflated, while they are not. If this price excursion stops this week, we forecast oil price to move lower and find first bottom around $76, second bottom towards $71.

Explanation:

The comperative inventory (C.I.) increased slightly this week. The price that ought to be for this C.I. is around $76. Price clearly moved higher, hence the price excursion. Price excursions can last for weeks, sometimes months.

The weekly C.I. change has increased, in line with its trend since about June 2022. This is in itself is bearish for oil price.

The VWAP for oil price has come back to its average. Unlike a few weeks ago price was at its st. deviation down. When price is at its standard deviation down this is an indication price may move upwards.

The Unaccounted for Oil is significantly higher this week then previous weeks. This weeks large withdrawal suggests an expectation that prices may move lower in the future, as oil owners want to maximize profits.

Overall, we do not forecast higher prices unless some news event occurs.

*****

03 Feb 2023

What did prices do and how can you make use of this?

The WTI oil price clearly ran out of steam and started to decline at the beginning of the next week (week of 30th Jan 2023). It found initial support as forecasted, around $76. Then, it moved and bottomed at $73,37.

If you were planning to hedge fuel or buy SAF on Monday morning 30th Jan 2023 you would have bought at $80,53.

By being flexible when buying and knowing about the dynamics, you benefited about $7,16.

And that equates to a lot more additional SAF for your operation and the globe.

This is how we can help aviation.